The Importance of Data Analytics for Decision Making

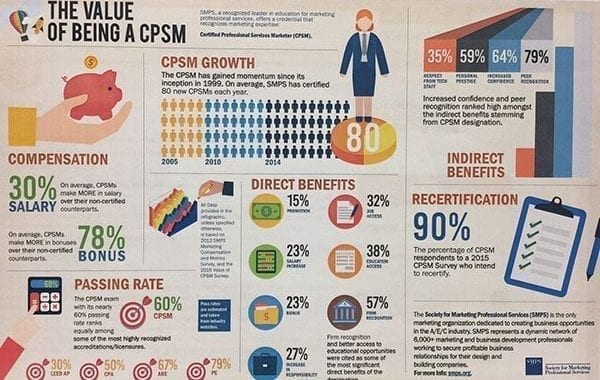

The Importance of Data Analytics for Decision Making How can you stay informed? Data analytics is the analysis of raw data to make conclusions. Businesses can use these conclusions to make informed decisions about their consumers. Of course, there are…