Be intentional about including the following tactics in your new year marketing strategy As 2025…

SMPS – CPSM Exam – Industrial Marketing Research

Industrial Marketing Research is about Real People & Real Relationships making Reality. You’re not selling lip stick.

The Certified Professional Services Marketer exam will make you an excellent resource for your company and your career. It brings together a rock solid methods for understanding your company’s strengths and doing good industrial marketing research to get new work in new industries. It’s not hard to continue to get work similar to your current expertise. All you need to do is very high quality work, on time and on budget.

It’s much more difficult to enter new markets that you don’t have experience in and no body knows you. The CPSM Domains of practice show you how you start with your people and their talents and grow from there. The case study uses a firm that has designed schools and illustrates how they used industrial marketing research to successfully grew into a similar building type, high end retirement homes.

In the case study we are using to study for the exam, the new management person has been given he task to manage the business development team. From the case study:

“Thanks in large part to your efforts as the marketing coordinator, Gilmore & Associates has successfully transitioned into a new market. The firm used to only be known for designing K-12 educational facilities, but with a few high-visibility retirement community projects under its belt, it’s begun to establish itself as an expert in this niche of older adult healthcare.

Firm leadership has recognized your role in this transition by offering you a management position. You agree to take on the responsibility of coordinating the efforts of staff and consultants to accomplish marketing goals and objectives, and ensure that every step in the sales process-from BO to writing a proposal-continues to run smoothly.

1. What are some processes that you could put into place to ensure the best possible outcomes for your marketing staff’s performance?

2. What should be included in a pipeline report to help you track activity, hold your team accountable and ultimately help your firm reach its annual growth goals?

3. You notice that many members of your team express discomfort with their BO role. How can you create a training program that will build the skills that they need to develop more confidence in this role?

4. One of your team members has decided to go back to school to study nursing and you need to hire someone to fill the open marketing associate position. What can you do to make your firm an appealing choice to job seekers?

5. What steps can you take to promote a firm-wide BO culture?”

Items one and two are with regard to the research you need to keep up with. Also in the answer key are a few other bullets regarding research.

Answer Key

1. What are some processes that you could put into place to ensure the best possible outcomes for your marketing staff’s performance?

• Set clear expectations. Measure each staff member’s knowledge areas and skill sets, and, based on those results, develop metrics by which they will be evaluated. Also encourage them to gain additional training and certifications, where needed.

• Provide opportunities for your staff to find a mentor or coach. These relationships can greatly enhance their professional development over both the long and short term.

• Establish clear lines of communication and provide regular feedback. Have regular team meetings about current and planned activities, as well as more informal one-on-one discussions about how each person is performing.

• Help them to develop a PDP that identifies a path for their individual professional development within the organization.

2. What should be included in a pipeline report to help you track activity, hold your team accountable, and ultimately help your firm reach its annual growth goals?

• Information about each lead, including which staff member brought it to your firm’s attention, which staff member will head follow-up activities and whether the lead is a previous client or a prospective one Information about the market and service sector that potential new work is associated with

• A rough approximation of how much revenue that the project might bring into your firm and how much it will cost to pursue it

• How likely you are to win the work based on what you know about the opportunity ”

The underlined sections relate to research. You need to be aware of the landscape you are working in. Research does that. You have to be sure the market is there and that you will be able to profitably work in it. Your research will go into a pipeline report for your management. The history of a market will confirm the amount of work available and your obtaining some percentage of that work will how your staff accountable. Without knowledge of available work and your obtaining it, you have no marketing plan.

I’ll go through the contents of the Marketing Research Domain 1 and comment on each section as a review for my test. Remember, my interest in all this is to move my advertising agency from industrial to architectural and engineering work. I already have my fair share of the industrial accounts in the region. The built environment and building materials market is much larger and the agency will have more opportunities to grow during this resurgence in the economy.

Domain 1: Marketing Research

Navigation Menu

Introduction

1. Research Fundamentals

1.1 Understand the Value of Market Research to Your Firm

1.2 Understand Basic Marketing Research Definitions and Principles, and the Different Types of Research and Research Designs

1.2.1 Strengths, Weaknesses, Opportunities, and Threats (SWOT) Analysis: The Foundation of Strategic and Marketing Planning Process

I’m not sure how this fits into the research component but you don’t want to go after the wrong business sector. Donald Trump said, “Never get into a new market on a downturn.” This is exactly what I realized when I tried to get into the building market and the economy collapsed. So I put it on the back burner until now when times are good in infrastructure.

SWOT is important because you can only grow based on your strengths. You must enter related markets first. For the agency it has been internet marketing, it’s an easy transition to new markets on the internet because it’s more important to know the programming first and the industry second. Both help.

A lot of the time, I go to large trade shows to do research. Back in the 90s I decided to go to the huge machine tool show in Chicago to visit regional companies on the show floor. I spent days reviewing the directory locating companies in greater Cincinnati. I must have visited three dozen firms and introduced myself to the VP of Sales. To make a long story short, I got the account but the VP left for another company in Milwaukee. Two months later I was working for them.

1.2.2 Life Expectancy of Products, Services, and Market Trends

1.2.3 Primary vs Secondary Research-What They Are and When to Use Each

For a lot of small firms this comes down to the numbers and your gut feelings. The most important thing about working for a new company is the chemistry between you and the client. It’s nearly impossible to understand most of the chemistry inside a client. You have to rely on your champion to help you navigate.

1.2.4 Quantitative vs Qualitative Research-What They are and When to Use Each

First you have to have a large enough market. Second you have to be liked by your client.

1.2.5 Exploratory vs Confirmatory Research

Explore to find new markets, do an experiment to confirm your hunches.

1.2.6 Evidence-Based Marketing

Sam Walton, the founder of Walmat used to fly around a region he was considering for a story. From the air it’s easy to see the neighborhood density and the traffic patterns.

Another great technique in marketing is to do a survey and share it with your prospects of sell the data to your competition. Here”s a blog post that I have collected all of the Green Building Marketing research done in the US, http://green-cincinnati.com/how-to-create-green-building-marketing-communications/.

1.3 Research Steps

1.3.1 Define the Problem and Narrow the Research Objectives

What is my problem? Not enough consistent work. Good clients feed us regular work. Media, blogging and ad words are regular work. Most recently, a new internet development services web site has created a regular stream of work. We are looking at that experience much more closely to see if we can do the same with 3D illustration and industrial photography.

1.3.2 Collect the Data

1.3.3 Analyze the Data

1.3.4 Present the Findings Verbally and/or in Writing

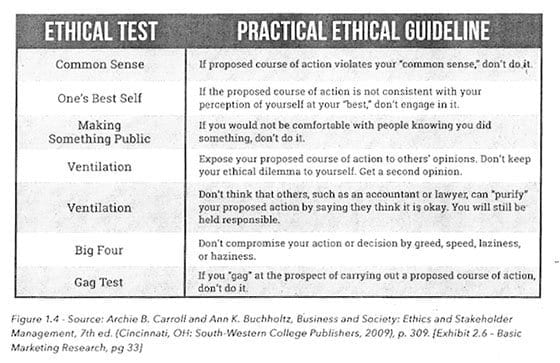

1.4 Ethical and Legal Issues Related to Marketing Research

Everyone cheats on their taxes a little bit. Do you really have morals? Do the right thing.

1.4.1 Utility

1.4. 2 Justice

1.4.3 Rights

1.5 Key Terms

2. Review and Refine the Focus of Your Research

2.1 Conduct a Company Audit

None of our keywords rank very high. They are typically very hard to rank for because marketing over saturates the internet. The ridiculous strategy to rank high for esoteric keywords is pretty dumb. Why would anyone want to waste time writing blog posts for “Industrial Google Ad Word Strategies?”

2.2 Define Your Research Objective

I don’t think the lack of consistent work is the real problem. The tree of us need to be busy enough to keep three part time assistants busy. Three is the magical number that you are reaady to hire a new person. We only recovered from our last recession and hired Myke on full time three years ago. We are growing but the pace is way too slow. The economy is doing very well now and there is a lot of work.

2.3 Document Your Research Objective

The Domain book has a great example of a company that asked What? and didn’t ask ‘What’s most important?

2.4 Determine Relevant Data Points

Includes measuring ROI on a marketing brochure, I’ve never seen an ROI for literature. They are used to prompt the sales force to present the marketing message in sequence. One brochure was done in 1977 and only reprinted until 2000 when the company went out of business. I guess longevity is one measure.

2.5 Key Terms

3. Sourcing Secondary Research and Monitoring Data and Trends

3.1 Identify Sources of Relevant Data

3.1.1 Categories of Resources

3.1.2 Literature Search

3.1.3 Data Mining

3.1.4 Conduct an Audit of the Information Available Internally

3.2 Monitor Social, Demographic, Cultural, Economic Trends/Monitor Industry-Related Market Info/Monitor Federal, State, Local Regulator}’ Matters

3.2.1 Maintain a Network of Contacts to Keep Abreast of Relevant Markets and Trends

3.3 Set up Systems to Gather, Store, and Monitor Data

3.3.1 Internal Reports

3.3.2 Research-Gathering Marketing Intelligence 3.3.3 Marketing Research Systems

3.3.4 Analytical Marketing System

3.4 Real Simple Syndication (RSS) Feeds

3.5 Key Terms

4. Designing and Conducting Primary Research Studies

4.1 Establish Your Research Plan (Design the Research Study)

4.1.1 Determining Your Budget

B + K x R x 1/F

BUDGET = Profit KOST at stake x Percentage research will reduce RISK x 1/ROI of new market

We’d like to increase sales by $300,000

$1,000 = $30,000 x 30% x 1/10th

4.1.2 Estimating Time

4.2 Understand the Best Applications to Gather the Information Needed

4.3 Understand How to Administer the Research

4.3.1 Define the Sample Size

As a rule of thumb, a minimum reasonable number of completed surveys or interviews is 25.

4.3.2 Encourage Participation

4.4 Surveys

4.4.1 Types of Surveys

Client satisfaction feedback

Perception

Market intelligence thought leader

Benchmarking

Internal

Focus

4.4.2 Survey Methodologies Overview 4.4.3 Creating Effective Surveys

4.4.4 Types of Questions

4.4.5 Using/Reusing Survey Intelligence

4.5 Ethical Considerations

4.6 Conducting your Own Research vs Hiring a Consultant

4.7 Key Terms

5. Forecasting/Modeling

Forecasting is the ability to predict a future event. The goal is to make the best decision.

5.1 Introduction to Forecasting and its Value to the Marketer

5.2 How to Forecast

5.2.1 Create Scenarios to Prepare for the Future 5.2.2 Anticipate Wild Cards

5.2.3 Iterative Rolling Forecasts

5.3 Trend Assessment Techniques

5.4 Introduction to Knowledge Management and Data Modeling

5.4.1 Marketing Information System (MIS)

5.4.2 Decision Support System (DSS)

5.4.3 Customer Relationship Management (CRM) System

After years of trying to think about what would be the best CRM, I’ve decided to just use sacks of business cards!. They worked well on the show floor and are a great lightweight way to prepare for checking in with old and new prospects at the next show. Some of those names will get entered into my iPhone contact list.

5.4.4 Data System

5.4.5 Model System

5.4.6 Marketers and IT

5.5 Key Terms

6. Analyzing/Interpreting Research

Every time I go to a new show the most important research I do is to take the time to sit down and review the show guide. There is where I force myself to read the name and address of each company. Of course that doesn’t work with the new trend in shows, not to publish the addresses of exhibitors.

6.1 Review/Verify Data

6.1.1 Validating Primary Research

6.1.2 Validating Secondary Research

6.2 Sort, Code, and Enter Data

6.2.1 Manipulating Quantitative Data

Averages are just that, a median in the middle data point on the list of samples.

6.2.2 Manipulating Qualitative Data

6.3 Interpret/Apply Your Results

6.3.1 Evaluating Qualitative Data

6.3.2 Evaluating Quantitative Data

6.3.3 What to Avoid

6.4 Key Terms

7 Document/Present Findings

7.1 Understand the Basics of Communication Methodology

7.1.1 Best Practices for Reporting Findings in Different Forms

7.2 Information to Include in Your Report

7.3 Creating Visuals

7.3.1 Comparison Charts

7.3.2 Contribution Charts

7.3.3 Distribution Charts

7.3.4 Trending Charts

7.3.5 lnfographics

7.4 Key Terms

8. Case Study Activity

The case study section follows the path of the engineering firm getting out of schools and into retirement homes on the hunch of their CEO. Research confirms his hunches: young familes are growing up and growing old. Surveys find the skills you have to serve the new market and a better Customer Relationship Management program to keep the business development team on the same page.

9. Glossary

10. Related Resources